⚡ UK secures 8.4GW of offshore wind in major clean energy boost ⚡

January 22, 2026

North Sea Clean Energy Agreement Signals Major Boost for Offshore Wind

January 26, 2026UK Energy Market Summary to Friday 23rd January 2026

Closing prices 23.01.2026

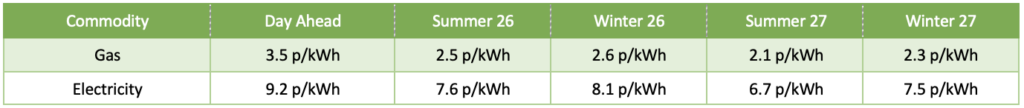

Colder weather and rising European gas withdrawals pushed the British spot price up by 15% to 3.6 p/kWh on Wednesday, marking the highest level in almost ten months. The market was further supported by lower US LNG flows and unplanned maintenance in Norway. Further along the curve, the Summer 2026 delivery contract surged by 4.6% to 2.5 p/kWh, driven by heightened geopolitical risks and a swift shift in market sentiment.

Milder weather forecasts and higher nominations from Norway put downward pressure on British gas prices on Thursday, pushing the NBP spot down 5.5% at 3.4 p/kWh. Further along the curve, the Summer 2026 delivery contract decreased by 2.4% to 2.4 p/kWh. Meanwhile, extreme cold expected in the US could trigger freeze-offs in Texas pipelines, potentially disrupting LNG flows.

At time of writing, European gas storage levels are 46% full, with the UK 41% full. European gas storage levels are trending at the low of the 5-year average. Over the past week gas has accounted for 25% of the UK generation mix with wind accounting for 49%, solar 1% and nuclear accounting for 10%. Below summarises curve prices as at close of business on Friday.

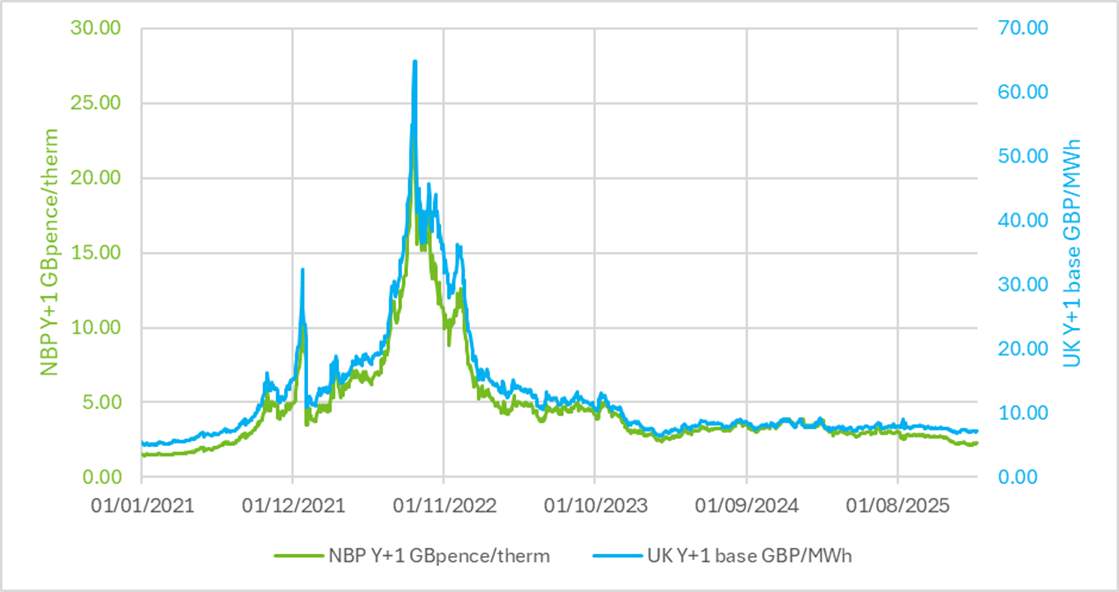

Curve UK Gas & Electricity Markets

Other Energy Markets

Brent crude oil prices saw a sharp downward correction on Thursday, plunging by over 4% to settle at $63.76 per barrel, as concerns over a potential U.S. intervention in Iran eased.

Supported by a rebound in gas markets, European carbon prices also climbed on Wednesday. Commitment of Traders data indicated that speculative positions in EUAs remained stable, while TTF contracts recently shifted to net long.